Wednesday December 07, 2022

People just really don’t know what to expect anymore when it comes to markets.

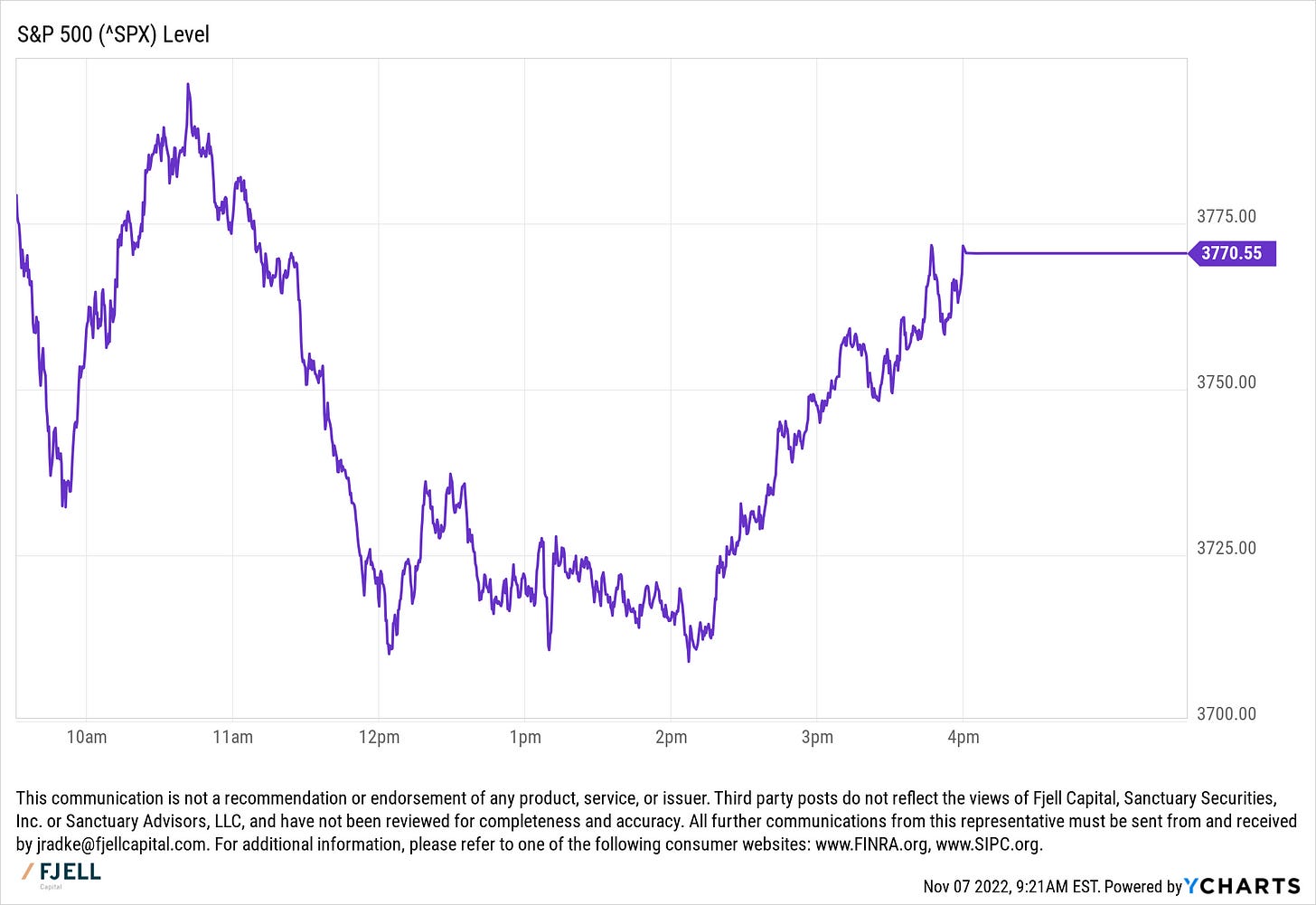

People just really don’t know what to expect anymore when it comes to markets. On Friday we had both unemployment data and payroll data get released and markets rallied on unemployment being higher than expected, 3.7% vs 3.5%, then faltered on news that payrolls still grew by 261K, vs. expected 205K. Within a matter of hours, the markets had completely reversed and then later reversed again. At the end of the day, it’s all speculation on the Fed and the aggressiveness of their path.

The Fed Chair entered the press room last Wednesday and told market participants that they have not changed their minds on the path of monetary policy and that they may be required to bring rates higher than previously expected to bring down inflation. Of course that sent markets on a downward bout of selling, which closed the day over 3% down on the Nasdaq Composite.

But are they going to send us into a recession, of course, whenever Jerome Powell says the word pain, it’s really him saying recession.

There will be pain ahead = There will be a recession ahead

No sitting administration wants its Fed Chair to be saying recession frequently though.

So why then do I say crazy markets; crazy people? It’s because markets are people, and when the market is a little crazy that means that people are a little crazy. If you panic and sell out then that will contribute to the market falling.

The end of days are not near, nor will they be caused by the Federal Reserve raising interest rates another 0.5%, it just won’t happen. You likely won’t even notice that as an individual, I mean really if you couldn’t see your 401(k) or investment account balance would you even know things were bad, probably not. Even higher mortgage rates are in part driven by banks increasing reserves, not just because the Fed is raising rates.

More reserves = less lending = less supply of mortgages

Less supply of mortgages + same demand for mortgages = higher rates

The Fed is doing its job to calm inflation by the only means it has, by slowing demand in the economy, and that means you have to spend less. Now it’s of course bad for businesses when you spend less and in turn bad for your job, but the reason we got here is because we’ve all spent too much, reverting back to the mean is just a natural part of economic growth, a part of the business cycle. Is it painful yes, but the waiting is the hardest part.

We, right now, are in the hardest part of the cycle. We are just waiting for something to break and we don’t know where that will be. But the job is getting done.

So why then do I care about jobs and why do I watch the market action on the vitals of the US economy? Simple the more markets act in the opposite way you would expect the closer we are to things being over, ie. the good news is bad news and the bad news is good news.

Fewer jobs = a bad thing = market rally (pushing closer to the end and a marked recession)

So then to get to the meat and potatoes of this conversation.

Don’t invest in the present, the present isn’t what moves stock prices. So a recession is already priced into the markets, and that’s why they have fallen. So naturally, you can draw a conclusion that the next thing to be priced into the market will be the recovery.

The hard part and the thing you shouldn’t do is try to time the pricing. No one knows for sure when the recession pricing will be over and no one knows for sure when the recovery pricing will occur.

I think there is a perfect quote for the times that we are living in and it comes from the great Michael Scott, “know what would be a great picture here? Just this whole dump, and in the middle, one flower. That's it. And the caption would read: hope grows in a dump.” Simply because when everything is bad, good things are bound to follow, it may not be today, next week, or even next month. But at some point in the future things are going to get better.1

This communication is not a recommendation or endorsement of any product, service, or issuer. Third party posts do not reflect the views of Fjell Capital, Sanctuary Securities, Inc. or Sanctuary Advisors, LLC, and have not been reviewed for completeness and accuracy. All further communications from this representative must be sent from and received by jradke@fjellcapital.com. For additional information, please refer to one of the following consumer websites: www.FINRA.org, www.SIPC.org.